The SA100 form, or self assessment, is a paper form that is used to provide HMRC with all breakdowns for all forms of your income during a particular tax year.

Employed people will normally have their income tax and national insurance (and other deductions if applicable) taken from their regular payslip - as employers run a PAYE payroll.

Self Employed people, people with multiple sources of income, or people with more complicated incomes like property, shares and foreign income will generally use the 'Tax Return' to make sure that they are paying the correct tax and NICs.

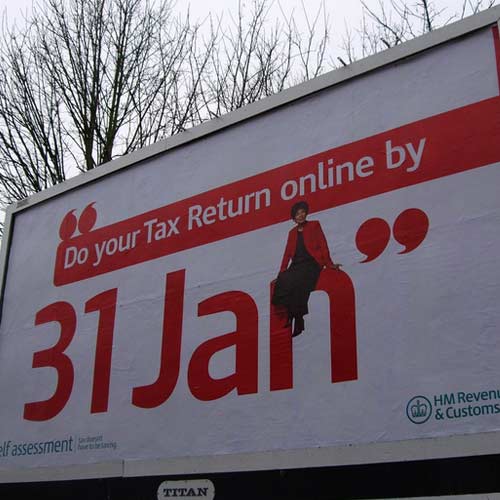

The paper return version of the return has a deadline of October 31st following the end of the tax year. The online version has until the next January 31st following the end of the tax year. Either way, for most cases, payment due is required by January 31st. Taxes to be collected are based on the payment on account system which mean on your first tax return you likely will pay the entire tax bill calculated for the previous tax year, plus roughly half of the tax estimated for the following tax year (of which you are at that point, more than half way through). Another payment on account is taken at the end of July and the two together should go toward making sure you always have your finances in order once the tax bill comes round.

The tax year runs from April 6th to April 5th the following year. At the moment this requires only one tax return per year and HMRC provide the online system to submit it. In the near future this system is changing and whilst HMRC will still provide an online system (making tax digital), they will mandate that the majority of people use accounting software to keep track of their income in real-time and submit tax returns multiple times during the tax year.

As always, you can fall foul of penalties and fines if tax returns are late or payments are not made on time. Penalties within the Self Assessment system are particularly rough with multiple time-increased lump sum penalties as well as daily interest on any outstanding taxes.

How to get started

Firstly, make sure you are registered with HMRC for self assessment as soon as possible. This enables you to get the required codes and access for the online system or your UTR for the paper version. With all business you would already be aware that detailed records must be kept for a period of time and these will need to be used to form the basis for the details provided on your tax return.

You can use our self employed tax calculator estimate your tax liability from multiple incomes. This is handy if you want to see where you stand before filing.

If your records are all tidy enough, the actual process of filing is fairly straightforward with the online system and paperwork quite foolproof. Your records will need to be summed and you need to be aware of what income to declare, what expenses are allowed and how to keep track of your capital allowances and more. There are many tools and guides that will assist you with these factors.