With the introduction of the High Income Child Benefit Charge since January 2013, anyone with an income above £50,000, whose family is claiming child benefit must pay up to 100 percent of their Child Benefit back to HMRC.

The process involves having to register for Self Assessment and declaring income details for the charge to be calculated.

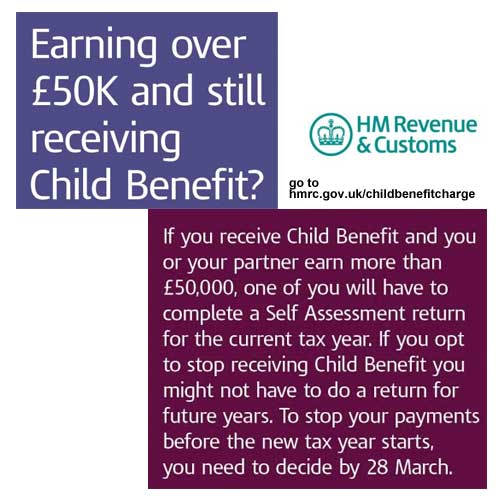

However, with the approach of the 2013/2014 tax year, people earning £60,000 or more can avoid paying a charge and filling a tax return for the 2013/2014 year by opting out before March 28th.

This means their benefit will stop but as the charge is equivalent to the entire benefit amount, the extra administrative burden is removed.

People with an income of between £50,000 and £60,000 are still entitled to Child Benefit, but the charge is equivalent to a percentage of benefit as the rate of 1 percent for every £100 of income between £50,000 and £60,000.