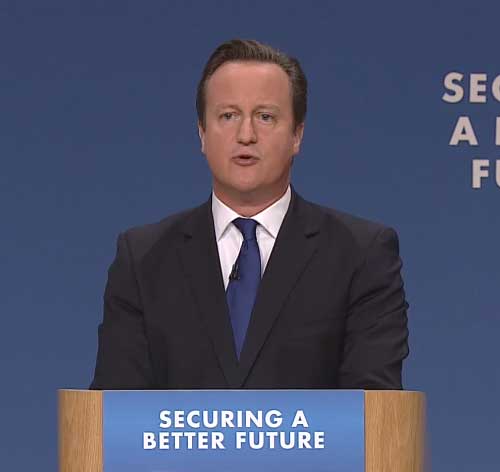

In a speech recapping the coalition's attempts over the last four years to remedy effects of past economic troubles, Prime Minister David Cameron also detailed the Conservative's pledge on taxation for next year's General Election.

Now that the personal tax free allowance for all has reached £10,000 - and is increasing to £10,500 from April 2015, Cameron promised to increase it by another £2,000 to £12,500 in the next Parliament.

A move that would remove an additional one million people from income tax (no word on national insurance contributions) and an income tax cut for thirty million more.

Recent Budgets have seen any increase in personal allowance amounts countered with decreases with the threshold at which higher rate (40%) tax is calculated. Cameron proposed to raise the threshold to £50,000 - but stated that it is currently £41,900.

The current threshold (2014) is £31,865 but with a full £10,000 personal allowance allows an individual to earn £41,865 before being liable to higher rates of income tax. If the amount an individual can earn increases to £50,000 but the personal allowances increases to £12,500 this means the higher rate threshold would increase to £37,500.

So overall, an extra £2,500 of tax free allowance and individuals can earn an additional £5,635 before having income tax assessed at the higher rate.

The Government has consulted on the merging of income tax and national insurance recently, but as yet has declared it would be a huge and complicated task. At present, National Insurance Contributions are due on incomes below the personal allowance point - at twelve percent. If the two were merged and the rates aligned, Cameron's promise of taking minimum wage workers completely out of taxation (as in all pay deductions) would be true.