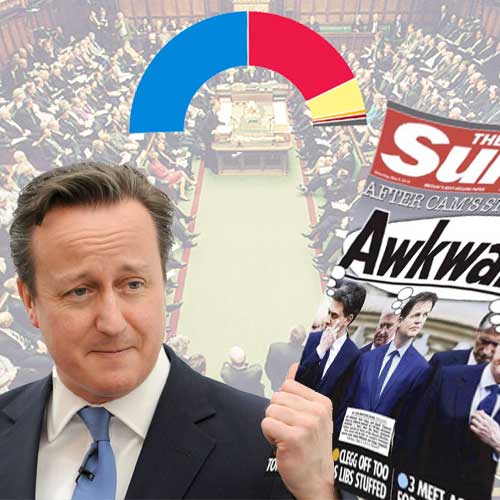

Now unhindered by Nick Clegg and the Liberal Democrats, the Conservative Party is free to put their ideas into action over the course of the next five years of Parliament.

We will start by re-visiting the manifesto released a couple of months ago and pull out the promises made there:

- Create 3 million new apprenticeships.

- Increase tax-free personal allowance to match 30 hours per week at the minimum wage at £12,500.

- Not raise VAT, National Insurance or Income Tax rates.

- Increase the higher rate (40%) threshold to £50,000 (before allowances), or £37,500 up from today's £31,785.

- 30 hours of free childcare for working parents of 3-4 year old children.

- Inheritance tax threshold increased to £1 million.

- State pension increases to track by at least 2.5 percent.

- Overhaul the welfare system - more on this later.

- Right to buy housing extended.

- 200,000 starter homes built for first-time buyers aged under 40, and to be sold at 20 percent below market value.

- Raise minimum wage to £8 by 2020.

The above are the party's main promises. These need to be funded by moving spending around or creating increased income through growth. Here are the ideas the Conservatives put forward:

- Increase the resources put into kerbing and punishing tax evasion and tax avoidance.

- Pay down the nations debt by running a budget surplus.

- Utilise a strong economy to create additional income, not borrowing, to invest in public services.

- Reduce 'wasteful' spending - this includes making savings in welfare.

- Invest in regions outside of London to create new economic 'powerhouses'.

- Invest in infrastructure such as roads, trains and communications.

- Corporation tax rates are now at 20 percent - the lowest in the G20.

- Employers of under 21 year olds and apprentices under 25 no longer pay Employers NICs.

- Small business support package of £2,000 employment allowances, business rate cuts, apprenticeship support and cuts in red tape.

- Support for local communities, R&D and investment in farming.

The welfare system will see major changes with the continued roll-out of Universal Credit and includes capping benefits to a max of £23,000 p/a - a cut of £3,000. More information is not available for the exact changes, but as part of the Lib Dem campaign, they stated the following ideas were blocked by them:

- Remove the higher rate child benefit from the first child - so all children receive the lower additional rate only.

- Child benefit is to become means-tested rather than only cut between £40k- 50k.

- 16-19 year olds no longer eligible for child benefit.

- Child tax credits and the child benefit limited to only two children per family.