If you are looking to supplement your main income this could be from a variety of sources:

- Adding additional hours to your regular employment - or regular overtime.

- Taking on an additional job in the evenings or on weekends.

- Starting a self employment - whether this is driving for Uber or similar, trading goods on eBay or similar - or many other forms of small enterprise.

- Buying and selling shares or investing savings.

- Purchasing property for rental purposes.

All these forms on income supplementation are treated to different types of tax and national insurance - and other deductions like student loans. The order in which the taxes are applied also differ so it can be difficult to judge what the effect on tax would be - and exactly how much of the additional £500 a month you earn, you actually get to keep after deductions.

We have created two new calculators to help quickly and easily answer the following questions:

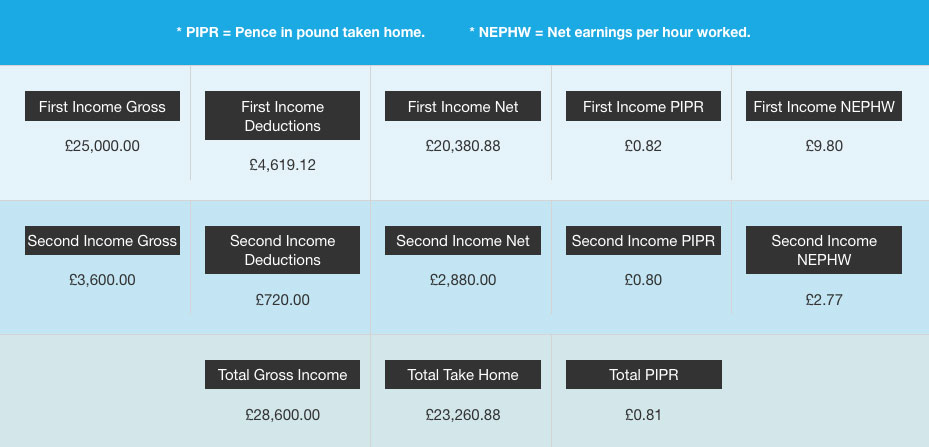

- Would you be better off with two jobs? - In this calculator you input your regular income (first income) details and then you input your second income details. The calculator will work out the amount earned in the second job and then work out the deductions that will apply. This shows exactly how much of the second job income you retain.

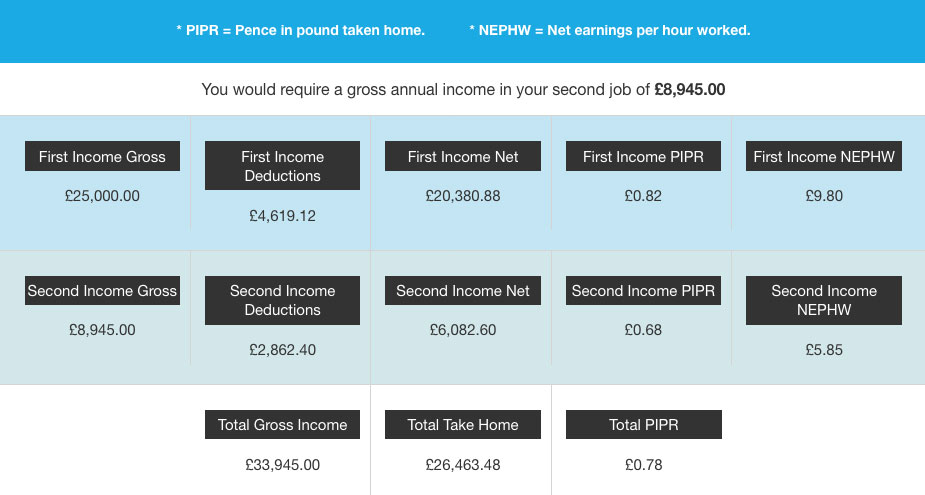

- In the second job calculator you enter your regular income (first income) details as before - but this time you input the amount you want to take home from an additional income source. The calculator will work out how much you need to earn before all deductions to match the take home amount.

An example below shows the result from the second job calculator to show how much someone earning £25,000 in their main job would need to earn to take home an additional £500 a month by working an extra 20 hours a week.

An example below shows the result from the better off with two jobs calculator. This one shows a person earning £25,000 in their main job taking on self employment earning £300 a month by an extra working 20 hours per week. It shows that over the year the self employment would earn £2,880 after deductions - equivalent to £240 a month.