People who disclose income information to the Taxman using a Self Assessment Tax Return and then have a tax bill calculated for the year of at least £1,000 are likely to be paying under the 'Payment on Account' system. This is applicable to most self assessment taxpayers - unless the total bill is less than £3,000 and they also work and pay tax via PAYE or have a pension and can have a tax code adjustment to collect the tax owed.

Payments on account mean the amount of tax calculated on your tax return is actually not the amount you pay, but instead you make two payments a year. The payments are calculated in the following manner:

- In January, the first payment is the entire tax amount calculated PLUS 50% toward the next tax year.

- In July, the second payment is another 50% toward the next tax year.

- In the following January, unless the two 50% payments fully covered the new tax calculation, there will be a balancing payment for the difference along with 50% toward the next tax year from the new calculation.

- The pattern then continues in this way.

If a person has already been making balancing payments then they would begin at step 3.

It can get quite complicated as what is included or not included in installments differs (such as student loan contributions). The system assumes that you will have the same tax bill each year but if you know in advance that your income has dropped you can apply to reduce the payment on account or get a refund later.

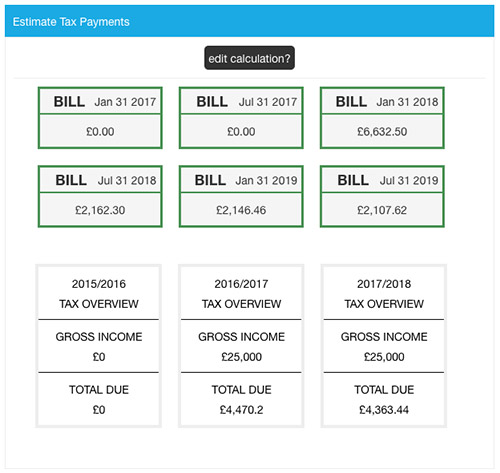

We have created a simple payment on account check to figure this out for you. All you have to do is enter your income details (multiple types of income accepted) for the last three tax years and the calculator will outline each tax calculation and each bill and the installments amounts and due dates.

Remember that HMRC will no longer accept credit cards for tax return payments - unless it is a business registered credit card. Late payments for the payment on account in July do not attract an instant penalty like the one in January, however interest is charged immedidately at 2.5 percent.