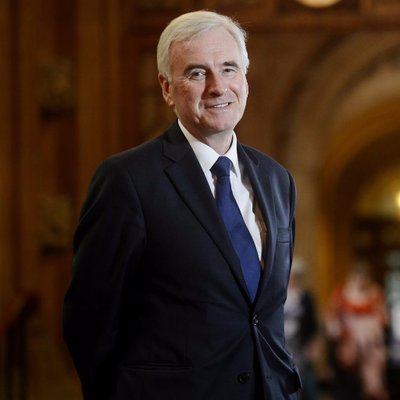

Shadow Chancellor John McDonnell put forward an alternative to last week's 2018 Budget after a row erupted in Parliament on who is set to benefit the most from next year's tax cuts.

Last week, Chancellor Philip Hammond set out 2019 tax rates and allowances that see the personal allowance rise to £12,500 and the higher rate threshold raised by £3,000 to £37,500. The means people would need to earn over £50,000 gross in order to be pushed into the higher 40 percent tax band.

Our analysis shows that people earning higher amounts of gross income are set to benefit by these changes more so than those at the lower end of the pay scale. Here is quick breakdown we posted to our twitter feed on Budget day:

- Gross Income £10k (£25 Better off)

- Gross Income £13k to 46k (£155 Better off)

- Gross Income £47k (£225 Better off)

- Gross Income £48k (£325 Better off)

- Gross Income £49k (£425 Better off)

- Gross Income £50k (£525 Better off)

- Gross Income £60k to £100k (£520 Better off)

Labour wants to amend the above to increase rates for those in the top 5 percent of income and intends to do so by putting forward the following drastic change to the tax system.

The differences in the alternative budget plan would reduce the top tax band of 45 percent, currently £150,000, to £80,000 and then a new tax band of 50 percent would be added at £125,000.

The plan has not been passed but if a scenario with Brexit forces another Budget in the Spring, or a General Election, then it is interesting to note the possible effects.