People from the European Union and living in the UK, but not having UK nationality, pay more income tax and national insurance than they receive via claims for tax credits (both out of work and working tax credits) and child benefit.

Statistics released by HMRC for 2015/2016 tax year show EEA nationals paid a total of £17.4 billion in combined income tax and national insurance. Paying in over £15.5 billion more than they claim (£1.9 billion). An upward trending figure.

In the UK of all families claiming tax credits, those with at least one EEA national make up 9 in every 100. There are 4.27 million tax credit claiming families in the UK, of which EEA national classed families make up 383,000. Non-UK EEA nationals claim around £2.5 billion in tax credits. UK nationals claim around £26 billion. The average tax credit entitlement for all families was £6,600 per year.

Families that claim tax credits but are out of work, thus entitled to out-of-work tax credits only are outnumbered nearly three to one by families that are in-work. Statistics show there are 66,000 families with EEA nationals claiming out-of-work tax credits. There are 1.23 million non-EEA UK families claiming out-of-work tax credits.

The figures provided above do not include other benefits claims such as Housing Benefits, but in contrast the income taxes do not include taxes such as businesses paying corporation taxes.

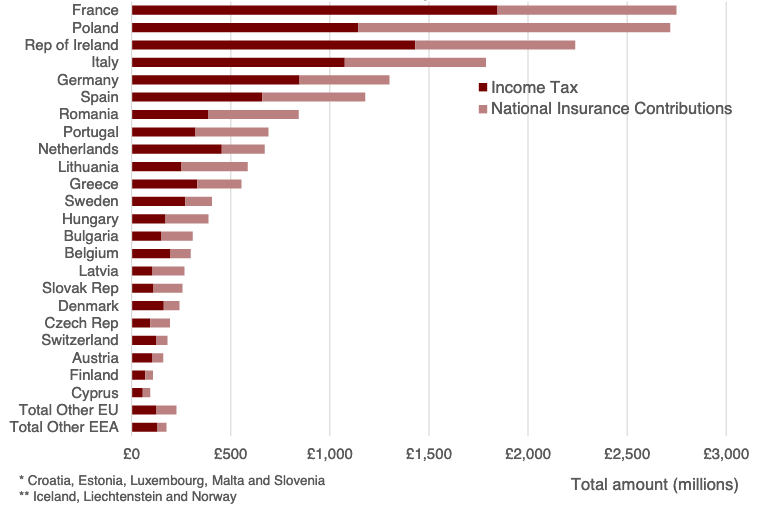

Breaking down the income tax and national insurance paid by EEA nationals by the country of origin shows top contributors, in descending order, to be from France, Poland, Republic of Ireland, Italy, Germany and Romania. See the chart below for the full country list.

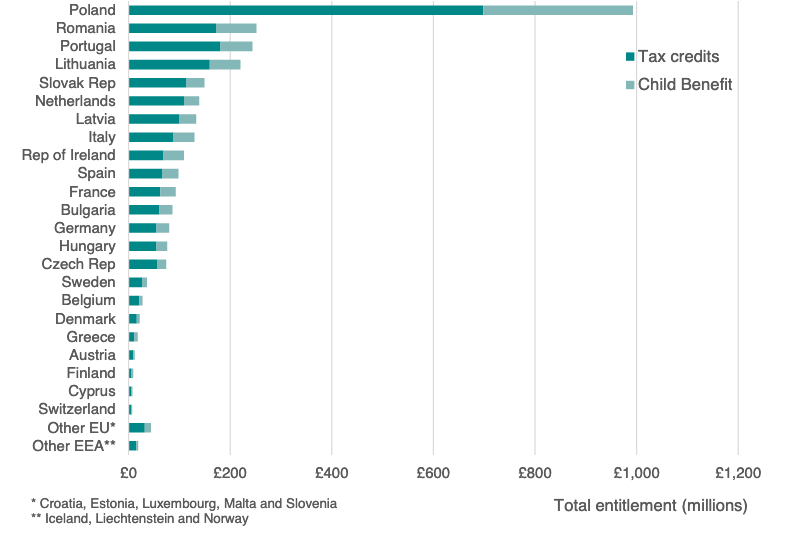

Breaking down the EEA national claimants of tax credits and child benefit by the country of origin shows them in descending order, to be from Poland, Romania, Portugal, Lithuania, Slovakia and Netherlands. See the chart below for the full country list.

The above stats were for the 2015/2016 tax year. In the following tax year, 2016/2017, EEA nationals contributed £21.3 billion in income tax and national insurance and claimed £3 billion in tax credits and child benefits. Taxes paid rising by (£3.9 billion) 22 percent and benefits claimed rising by (£1.1 billion) 50 percent.