Nearly 90 percent of people used HMRC online services to file their tax returns and, with the paper deadline having passed, only the online option now remains for filing a tax return.

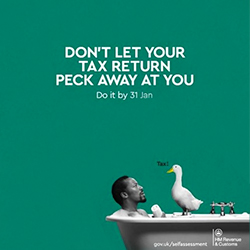

January 31st is now three weeks away and around 5.4 million tax returns are still outstanding so there will be the usual rush to avoid automatic penalties. Penalties include a £100 automatic fine on February 1st. Further fines are applied at intervals as the tax return continues to remain outstanding. Don't become one of the people to have missed the tax return deadline.

Not only is the tax return required, where information regarding income for the period April 6th 2018 to April 5th 2019 is provided, but payments also need to be made. Payments covering the balancing payment for tax due in the period as well as a payment on account for the current tax year are also made by the same deadline date.

A quick reminder on who normally is required to complete a tax return 2019:

- Annual income over £100,000

- Expense claims exceeding £2,500

- Sole Trader (Self Employed) with income over £1,000

- Income exceeding £2,500 from tips/commission, property rental, savings/dividends, foreign sources.

- A business partnership

- Child Benefit claimants where a partner has income exceeding £50,000

- People advised to complete a tax return by HMRC and have not been told in writing that it is no longer required.

A total of 11.7 million tax returns were due overall, 6.3 million of which have been submitted so far, with near 90 percent of those filed online.

As usual we have a number of tools to help you estimate or plan your tax so you can get an idea of what to expect before going through the full tax return process.

The time taken to complete your tax return can exceed three hours on average so try out multiple income tax estimate to see the tax due when multiple sources of income are declared. You can also read our tax return guide for an overview on completing your first tax return.