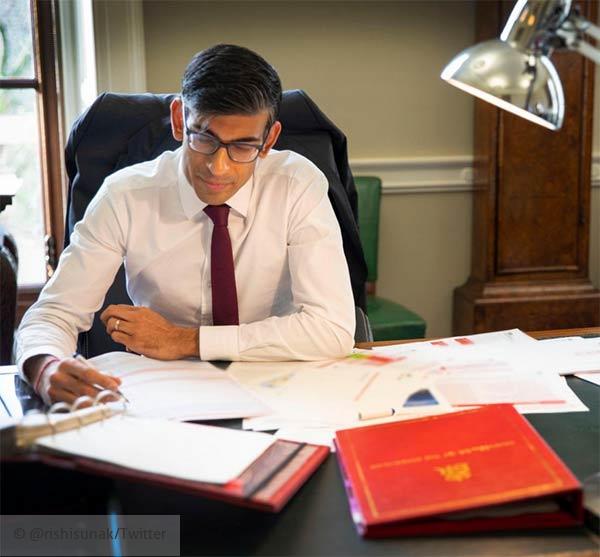

The Chancellor Rishi Sunak delivered his second Budget of the year (and third since becoming Chancellor) today. A Budget that was heavily leaked prior to this afternoon's speech was focused on a post-pandemic era of growth and opportunity.

The taxes that affect people most directly are currently frozen until April 2026, these are the personal allowance and the higher rate tax threshold. Since the higher rate is aligned to national insurance, that too is frozen, although the 1.25% levy is coming in next year to reduce take home pay.

Class One and Class Four NIC rates are increasing by 1.25% next year, this includes employers' NIC .

Dividend rates next year are rising to 8.75%, 33.75% and 39.35% in the respective ordinary, upper and additional rate bands. The dividend allowance remains however at £2,000.

Corporation tax remains at 19% in 2022, but rises sharply to 25% in 2023 - with a small profits rate of 19%.

Company car rates are to remain frozen, though VED rates are to increase by £5 per year for cars emitting 131+ g/km, £10 per year for cars emitting 151+ g/km, £15 per year for cars emitting 166+ g/km, £20 per year for cars emitting 201+ g/km, and £30 per year for cars emitting 226+ g/km. Euro 4 and 5 compliant vans registered after 2001 have no increase in VED.

No changes to Capital Gains Taxes or Inheritance Taxes were announced. The VAT registration threshold has not changed either from the current £85,000.

Air passenger duty for domestic internal flights to be reduced, while long-haul flights to receive a £91 per passenger at the economy rate increase.

Fuel duty freeze will continue, while alcohol duty is being overhauled. Rates will drop from 15% to 6% and stronger alcohols will pay more duty than weaker alcohols. Draught beer and cider receives a lower new rate which reduces duty by three pence per pint.

We have updated our calculators and tools to allow you to calculate for April 2022 onward but there are some limitations for now, for example the Scottish Budget is not until December so rates will not be published until then, and the expected lowering of the Student Loan Threshold for Plan Two loans was not mentioned today and the amount still remains to be confirmed.

The Budget announced that inflation is set to hit over 4% next year with the Bank of England being told to keep it low and steady. Normally the bank has a target of 2% to keep by adjusting interest rates, so it would be interesting to see how this unfolds as the UK economy is forecast to return to normal pre-pandemic levels by next year. Growth at the moment is 6% but this is inflated due to the slump and reduces gradually over the next few years.

Unemployment will peak at 5.2% next year, while wages have grown by 3.4% since the pandemic hit in Februrary 2020.

Debt as a percentage of GDP is at 85%, while borrowing as a percentage of GDP is falling to 3.3% next year and reducing to 1.5% over the next few years. Foreign aid spending commitments will resume before April 2024.