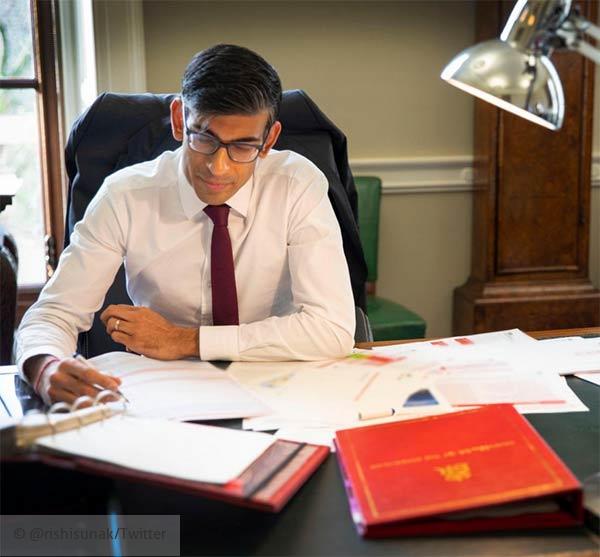

Chancellor Rishi Sunak today announced a new round of financial support for businesses being seriously affected by the emergence of a new variant in the ongoing pandemic.

Restrictions being applied during the busy holiday period have already seen the hospitality trade report loss of inflow by between 40 and 60 percent. A month considered by most to be the most profitable of the year.

A 12.5 percent reduced rate of VAT has been announced for around 150,000 businesses in hospitality and tourism. It will remain in force until the end of March 2022 and help protect 2.4 million jobs in the sectors.

Up to £6,000 per premises will be made available to businesses in the hospitality and leisure sector as one-off grants, with an additional £100 million to the Additional Restrictions Grant to help local councils provide additional support when required. The Culture Recovery Fund has received an additional £30 million to help cultural organisations through the winter period.

Over 200,000 businesses will benefit from these grants over the coming weeks, which will be provided through local authorities.

With more people taking time off work due to being sick or having to isolate, Sunak has also reintroduced the SSPRS, Statutory Sick Pay Rebate Scheme.

Small and Medium-sized employers (< 250 employees) will be reimbursed for sick pay costs for up to 2 weeks per employee. The scheme starts today and retrospective claims will be open from mid-January 2022.

Specialist sub-sectors in hospitality and leisure are also being provided additional support.

£240 million in total has been allocated this financial year to theatres, orchestras and museums, £30 million of which is added to cover for the next 3-4 months.

Devolved governments will receive apportioned additional funding of £150 million.

Other support or continuing support includes:

- Business rates relief - a 75% cut in rates for the financial year and 50% capped rates next year.

- Eviction protection for businesses behind on rent, lasting up to March 2022.

- Bounce Back Loans flexibility plans - 6 months payment holiday, 3 months interest-only, loan term extension to 10 years.

- Time to Pay arrangement for tax bills through HMRC.