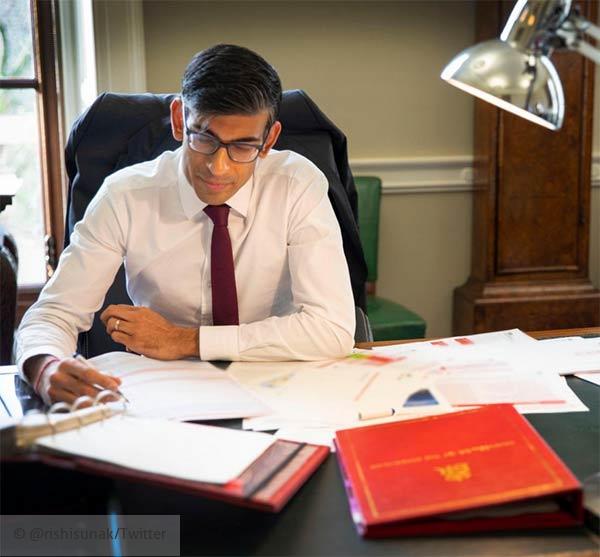

Chancellor Rishi Sunak is expected to deliver his Spring Statement tomorrow (March 23rd). Normally just a mini-Budget statement on the state of the government's economic and fiscal forecasts, this year the cost of living crisis combined with planned tax rises next month mean it could be an event of increased importance.

The ongoing conflicts abroad, rising Bank of England base rates, rising costs of electricity, gas and vehicle fuel, food basket inflation and fiscal drag plus NIC rate hike tax increases next month are all part of massive pressures on the cost of living - and it's all occurring at the same time.

The Chancellor has to step in and the already proposed council tax rebates and electricty bill loans will not be enough for many households.

The NIC rate rise from next month is an obvious one to postpone. You can use our NIC rate rise calculator to see how much the rise would affect you. Delaying this rise, so close to the start of the next tax year, is a major technical and administrative hurdle. If there is a way that company payrolls can manage to remove it, either directly or by adjusting another threshold to compensate - it should be an avenue to explore.

The Chancellor has a surplus (over forecasted) income worth £12.5 billion - as well as new measures to cuts costs which bring in £5 billion. Coupling this with OBR forecasts for lower borrowing than expected means more drastic cuts to taxes could be possible to ease the pain of households.

-

Make cuts to fuel duty.

Petrol prices could be getting close to two pounds per litre soon - averaging £1.67 for basic unleaded today. A rise of over 55 percent in just two years. Diesel is averaging £1.77 at the pumps.

There are reports that the Chancellor will take five pence of fuel duty tomorrow to ease the over £90 cost of filling an average fuel tank.

Fuel duty has been frozen at 57.95 pence per litre since 2011 - so what does a cut to 52.95 pence per litre do?

On a £90 fill up at the pump, the five pence plus VAT fuel duty cut would save £3.30.

The Irish cabinet cut their unleaded fuel duty at the start of this month by 20 cents (equivalent to 17 pence) per litre. Diesel was cut by a lower 13 pence - but still more than Sunak could be offering to do.

-

Change or scrap the High Income Child Benefit Charge.

This charge applies to people earning above basic rate (using a fixed £50,000 cut-off for gross incomes). The problem is people earning up to £50,270 are caught by the charge - and they are not higher rate taxpayers.