Chancellor Rachel Reeves will deliver her first Budget at the end of next month after repeatedly warning that she will have to make "difficult decisions" on taxes and spending. She will likely have to raise some taxes, with commentators placing their bets on inheritance tax, capital gains and pension tax reliefs.

To learn more about what Reeves could have planned we can take a trip to the recent past.

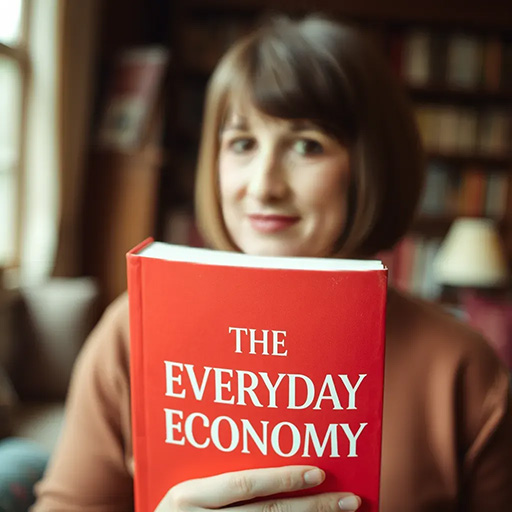

In a paper released in 2018, the then-Labour MP Rachel Reeves, now Chancellor of the Exchequer, outlined a series of radical tax reform proposals aimed at creating a fairer and more efficient system. The ideas, presented in "The Everyday Economy", have now gained renewed attention as Starmer's Labour government considers ways to address wealth inequality and boost public finances in light of the £20-30 billion financial black hole.

Reeves' paper, written during her time as chair of the Business, Energy and Industrial Strategy Select Committee, argued that the current wealth taxation system was failing and required a comprehensive overhaul. Her proposals were wide-ranging and ambitious, targeting various aspects of the tax system.

One of the most notable suggestions was the reform of council tax. Reeves proposed re-evaluating the outdated system based on 1991 property values and potentially replacing it with a property tax levied on owners rather than tenants. This move, she argued, would create a more equitable system and discourage the use of empty properties as investments. A return of the Poll Tax?

Inheritance tax was another area Reeves identified for reform. She suggested either resetting the system or shifting to a lifetime gifts tax to close loopholes that allow the wealthy to avoid paying their fair share.

In a bold move, Reeves also proposed introducing a land tax. This would target the 0.6% of the population who own 69% of UK land, potentially raising significant revenue from a previously undertaxed source.

Other ideas included increasing taxes on savings and investment income for higher-rate taxpayers, reforming capital gains tax, and restricting pension contribution reliefs for high earners. Reeves also suggested requiring 20% of pension contributions to be invested in employment-creating opportunities in exchange for tax reliefs.

Reeves estimated that these reforms could potentially raise over £20 billion per year in tax revenues, with an additional £20 billion in investment funds. She emphasized that the guiding principle for these reforms should be fairness - raising revenue without deterring enterprise or competitiveness, while minimizing tax avoidance and evasion.

As Chancellor, Reeves now has the opportunity to implement some of these ideas. While it remains to be seen which proposals will make it into government policy, her paper provides a clear indication of her thinking on tax reform and her commitment to addressing wealth inequality, funding ambitious public spending plans and address the economic challenges of inflation and cost of living.

Reeves' early ideas may well shape the future of the UK's tax system.